"My objection there was that those were no-bid contracts," Patrick is reported as saying in the Boston Herald. "I am not going to support no-bid contracts. That’s not going to change." That’s plain malarkey and misdirection, again, from Governor “too slick for it to stick” Patrick.

This is clearly just a play with words and another hollow pledge like his continually broken promise to not take money or have meetings with casino lobbyists. Patrick’s new pledge and his assertion that oversight would be “above politics” will be null and void with his reported “closed door” deal struck with Indian gaming and slots lobbyists for tribal preference carve out. You’ll note the Governor says only “one competitively bid slot parlor” while keeping the door open for multiple racetrack slots. Anyone following these shenanigans knows this is simply code that some deal has been cut between the Governor and Senate President Therese Murray with Speaker DeLeo.

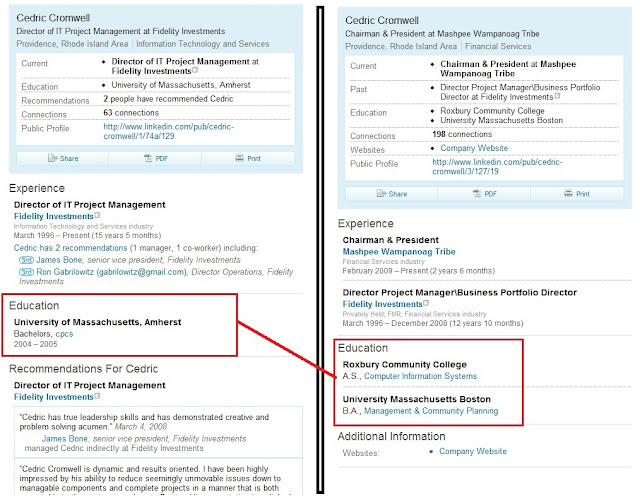

You see Deval Patrick and Therese Murray wanted a set aside for the Wampanoag (and thus his pal Doug Rubin and the slot machine companies whose lobbyists funnel cash to Patrick for his higher office political ambitions) who are now dealing with the Raynham Racetrack with their Malaysian financial backers. To quote Therese Murray – “Ca-ching!” Because, this likely takes care of Speaker DeLeo’s Suffolk Downs constituents but really means no-bid contracts and nothing but patronage for Cedric Cromwell’s gang on the South Shore while the Governor can still pay-off his promises to Rubin and the other lobbyists whose companies and off-shore interests benefit from this deal.

You see Deval Patrick and Therese Murray wanted a set aside for the Wampanoag (and thus his pal Doug Rubin and the slot machine companies whose lobbyists funnel cash to Patrick for his higher office political ambitions) who are now dealing with the Raynham Racetrack with their Malaysian financial backers. To quote Therese Murray – “Ca-ching!” Because, this likely takes care of Speaker DeLeo’s Suffolk Downs constituents but really means no-bid contracts and nothing but patronage for Cedric Cromwell’s gang on the South Shore while the Governor can still pay-off his promises to Rubin and the other lobbyists whose companies and off-shore interests benefit from this deal.

Patrick claims, "We need appointees who are above politics, whose ethics rules are even more rigorous than the reformed rules we put in place a couple of years ago. I think they need to be adequately compensated. I think they need to have appropriate oversight -- independent, yet appropriate oversight."

Yet, this or any de facto tribal preference setting aside “slot parlors” for racetracks or any Indian gaming in Massachusetts would be out of the purview of any state established oversight. Further, the concept of any set-aside or preference negates the principal of “no bid” contracts for any Massachusetts gaming operation. By setting aside “slots in boxes” for racetracks or other operations by tribal gaming groups, the governor guarantees no competition for gaming on those or nearby potential properties. So what will it be Governor? Will we be reading in the Globe or Herald again, like with your repeated casino lobbyist contributions and meetings, that this pledge is broken? The problem is another too cute for school trick of words here by the Governor as the assurance is meaningless from the start.

Even the dimwitted Scott Harshbarger sees through these schemes noting, “The secret, ongoing negotiating sessions” among the governor and legislative leaders. Harshbarger added, “Legislative leaders and the governor need to have this debate in the light of day and must openly address the many issues that have changed since the last true analysis of casino impacts was done - from economic costs and benefits to public safety, law enforcement and regulatory structures. Ramming through a misguided proposal with little true debate will only worsen public mistrust in state government.”

We’re told gaming is a done deal in Massachusetts so we should just shut up and take it. Why should we be forced to take the worse deal? Will this “done deal” plan will be presented and rammed through the legislature without even as much as an evaluation of its downsides when compared to a simple, fully competitive and open opportunity to get the best possible deal for the state and people alike?